Lower and lower, that is the continuing track for New Zealand mortgage rates this year. The current one-year fixed term rate of 2.25% hits the lowest. Will interest rates stay low in 2021? The property market is a bit over-heated now and how likely are interest rates. Looking forward, we estimate Deposit Interest Rate in New Zealand to stand at 0.26 in 12 months time. In the long-term, the Deposit Interest Rate in New Zealand is projected to trend around 0.51 percent in. Rates are available for Retail and Business Banking customers and apply up to the first $5,000,000 of deposits held either solely or jointly with Westpac. For rates applicable to amounts in excess of $5,000,000, please contact us. Rates are not available to Financial Institutions. A term deposit is an investment of cash placed with a financial institution for a fixed period of time, known as the term, with a fixed interest rate for your return at the end of the term. A term deposit is commonly referred to as a TD, but can also be known as a certificate of deposit.

ALL ARTICLESNZ Interest rates forecast for 2021 – Will interest rates stay low or back up?

Posted by: Connie in Interest Rates

Lower and lower, that is the continuing track for New Zealand mortgage rates this year. The current one-year fixed term rate of 2.25% hits the lowest. Will interest rates stay low in 2021? The property market is a bit over-heated now and how likely are interest rates to go up in 2021? It’s around the time of the year that we take an educated guess at what will happen with mortgage rates.

Prefer to watch Connie explain it all in a video? Have a watch below:

Video Timeline

1. Current home loan interest rates in New Zealand (December 2020 updated) - 00:45

2. Low mortgage rates will be here for 2021 - 01:45

3. Slowing down a hot property market, will this drive mortgage rates to go up in 2021? - 03:59

4. How long should I fix my mortgage for in 2021? - 07:39

1. Current home loan interest rates in New Zealand (December 2020 updated)

One-year fixed term rate: It’s the lowest one among all fixed-term rates. Many homeowners choose to fix their mortgage for one year not only because it’s the lowest one at the moment, but more importantly, they also predict that the interest rates are going to drop again in 2021.

18-month fixed term rate: It’s the second-lowest rate, just five basis points higher than the one-year rate. Another good option to fix for when the certainty is much important to you.

6-month fixed term rate: It’s above 3%, and relative a bit expensive – too close to the floating rates. There’s no real value going to the 6-month rate unless for a specific reason, such as selling your property soon.

2. NZ interest rates forecast for 2021 – Will interest rates stay low or go up in 2021?

Low mortgage rates will be here for 2021

Some economists predicted the interest rates might fall into negative territory next year, and New Zealand banks have been asked to have systems ready to accommodate. We haven’t experienced that before. If happening next year, they’ll need to get everything ready, the policy, process, system, and rates. However, some bank economists say negative interest rates won’t be there because New Zealand economy is recovering well. They expect the interest rates and OCR to drop further but won’t go below zero.

In the meanwhile, the Funding for Lending Program (FLP) proposed by the New Zealand Reserve Bank will push mortgage rates to drop further in 2021. Here’s how it works. The FLP lowers bank funding costs by lending directly to banks at much lower rates so that the banks can pass on that cheaper rates to home borrowers. Compared with leveraging OCR to lower the rates, the rates that FLP allows banks to lend at are not linked to the term deposit rates. That means the move to FLP won’t see deposit rates for bank customers drop down, considering the depositors are also one of the funding sources for banks.

In short, we believe it is very likely that the mortgage rates will stay low or even lower in 2021 than they are now.

Slowing down a hot property market, will this drive mortgage rates to go up in 2021?

Whilst low interest rates are a major catalyst for increasing house prices, no doubt you’ve heard about the Labour government are pushing reserve bank to do something to cool down the overheated market. To slow things down, will Reserve Bank push the mortgage rates to go up next year?

It may seem simple to drop the mortgage rates to slow down the current property market, but the rates are not set just for cooling the housing market. Lower interest rates also help control the inflation rate within the target range, encourage people to spend, stimulate the economy to recover. Tony Alexander, an ex-chief economist from BNZ, said the reserve bank might use the following two tools, rather than increasing mortgage rates, to control the housing market.

LVR (loan-to-value ratio) restrictions are coming back to 70%

On 1st May 2020, the New Zealand Reserve Bank(RBNZ) has removed mortgage loan-to-value ratio (LVR) restriction for property investment loans, as part of a range of economic stimulus measures designed to combat the recessionary effects of the COVID-19 pandemic earlier this year. The LVR restrictions were originally intended to be removed until May 2021, but the RBNZ just announced to bring that forward and reintroduce in March 2021.

In fact, some New Zealand banks are already reacting ahead of the RBNZ’s official effective date of 70% LVR restrictions on investment property loan. For example, on 11th November ASB announced to move immediately to increase the minimum deposit required for investment property loan from 20 percent to 30 percent. ANZ & BNZ said it would bring in 30 percent deposit rate from 7th December. Alex predicted there might be a chance that the minimum deposit for investors could be raised to as much as 40%.

The return of LVR restrictions may slow down a part of the market heat, resulting in some hurdles for property investors.

Debt-to-income ratio rules to be introduced, probably

Second, the Reserve Bank may request to introduce Debt to Income ratio rules which restrict how much home loan a bank can lend to a borrower based on the total income. For example, if the debt to income rule becomes effective and the ratio is six times, say your annual income is $100k, then the maximum loan amount that your bank will be allowed to lend you is $600k.

Although the rules haven’t been introduced yet, some banks already use this weapon. ASB, as an example, requests six times of debt to income ratio as an additional restriction when investors applying for 80% of LVR.

Having these two tools is more likely to help slow down and control the housing market down the track. So it is highly likely that the Reserve Bank won’t raise the mortgage rates in 2021 just for the sake of cooling the housing market.

3. How long should I fix my mortgage for in 2021?

If you have or about to come off a fixed interest rate, then the one-year fixed interest rate is a good option. Given that the trend for interest rates is a downward one, and no one knows exactly how quickly things will keep going down, you should be looking to keep the time frame of fixed rate short. Locking your mortgage for one year will give you the ability to pick up on a rate that may fall.

If you need certainty, then consider fixing a portion of your home loan for a longer period. In some cases that may potentially cause your income dropping or outgoing going up, such as you’ll have a new-born soon, yourself or the other half is going to stay at home to look after the little one, or you’ll start a new business soon, we often advise to split your loan into a couple of chunks. By this way, your loan will come off fixed rate at different times and leave room for you to make adjustment if necessary.

Prosperity Finance – here to help

If you would like to get more tailored advice, please feel free to get in touch. We are happy to review your situation and let you know how we can help. Call us at 09 930 8999 for a chat with one of our mortgage advisors.

More Articles:

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Lower and lower, that is the continuing track for New Zealand mortgage rates this year. The current one-year fixed term rate of 2.25% hits the lowest. Will interest rates stay low in 2021? The property market is a bit over-heated now and how likely are interest rates to go up in 2021? It’s around the time of the year that we take an educated guess at what will happen with mortgage rates.

Prefer to watch Connie explain it all in a video? Have a watch below:

Video Timeline

1. Current home loan interest rates in New Zealand (December 2020 updated) - 00:45

2. Low mortgage rates will be here for 2021 - 01:45

3. Slowing down a hot property market, will this drive mortgage rates to go up in 2021? - 03:59

4. How long should I fix my mortgage for in 2021? - 07:39

1. Current home loan interest rates in New Zealand (December 2020 updated)

One-year fixed term rate: It’s the lowest one among all fixed-term rates. Many homeowners choose to fix their mortgage for one year not only because it’s the lowest one at the moment, but more importantly, they also predict that the interest rates are going to drop again in 2021.

18-month fixed term rate: It’s the second-lowest rate, just five basis points higher than the one-year rate. Another good option to fix for when the certainty is much important to you.

6-month fixed term rate: It’s above 3%, and relative a bit expensive – too close to the floating rates. There’s no real value going to the 6-month rate unless for a specific reason, such as selling your property soon.

2. NZ interest rates forecast for 2021 – Will interest rates stay low or go up in 2021?

Low mortgage rates will be here for 2021

Some economists predicted the interest rates might fall into negative territory next year, and New Zealand banks have been asked to have systems ready to accommodate. We haven’t experienced that before. If happening next year, they’ll need to get everything ready, the policy, process, system, and rates. However, some bank economists say negative interest rates won’t be there because New Zealand economy is recovering well. They expect the interest rates and OCR to drop further but won’t go below zero.

In the meanwhile, the Funding for Lending Program (FLP) proposed by the New Zealand Reserve Bank will push mortgage rates to drop further in 2021. Here’s how it works. The FLP lowers bank funding costs by lending directly to banks at much lower rates so that the banks can pass on that cheaper rates to home borrowers. Compared with leveraging OCR to lower the rates, the rates that FLP allows banks to lend at are not linked to the term deposit rates. That means the move to FLP won’t see deposit rates for bank customers drop down, considering the depositors are also one of the funding sources for banks.

In short, we believe it is very likely that the mortgage rates will stay low or even lower in 2021 than they are now.

Slowing down a hot property market, will this drive mortgage rates to go up in 2021?

Whilst low interest rates are a major catalyst for increasing house prices, no doubt you’ve heard about the Labour government are pushing reserve bank to do something to cool down the overheated market. To slow things down, will Reserve Bank push the mortgage rates to go up next year?

It may seem simple to drop the mortgage rates to slow down the current property market, but the rates are not set just for cooling the housing market. Lower interest rates also help control the inflation rate within the target range, encourage people to spend, stimulate the economy to recover. Tony Alexander, an ex-chief economist from BNZ, said the reserve bank might use the following two tools, rather than increasing mortgage rates, to control the housing market.

LVR (loan-to-value ratio) restrictions are coming back to 70%

On 1st May 2020, the New Zealand Reserve Bank(RBNZ) has removed mortgage loan-to-value ratio (LVR) restriction for property investment loans, as part of a range of economic stimulus measures designed to combat the recessionary effects of the COVID-19 pandemic earlier this year. The LVR restrictions were originally intended to be removed until May 2021, but the RBNZ just announced to bring that forward and reintroduce in March 2021.

In fact, some New Zealand banks are already reacting ahead of the RBNZ’s official effective date of 70% LVR restrictions on investment property loan. For example, on 11th November ASB announced to move immediately to increase the minimum deposit required for investment property loan from 20 percent to 30 percent. ANZ & BNZ said it would bring in 30 percent deposit rate from 7th December. Alex predicted there might be a chance that the minimum deposit for investors could be raised to as much as 40%.

The return of LVR restrictions may slow down a part of the market heat, resulting in some hurdles for property investors.

Debt-to-income ratio rules to be introduced, probably

Second, the Reserve Bank may request to introduce Debt to Income ratio rules which restrict how much home loan a bank can lend to a borrower based on the total income. For example, if the debt to income rule becomes effective and the ratio is six times, say your annual income is $100k, then the maximum loan amount that your bank will be allowed to lend you is $600k.

Although the rules haven’t been introduced yet, some banks already use this weapon. ASB, as an example, requests six times of debt to income ratio as an additional restriction when investors applying for 80% of LVR.

Having these two tools is more likely to help slow down and control the housing market down the track. So it is highly likely that the Reserve Bank won’t raise the mortgage rates in 2021 just for the sake of cooling the housing market.

3. How long should I fix my mortgage for in 2021?

If you have or about to come off a fixed interest rate, then the one-year fixed interest rate is a good option. Given that the trend for interest rates is a downward one, and no one knows exactly how quickly things will keep going down, you should be looking to keep the time frame of fixed rate short. Locking your mortgage for one year will give you the ability to pick up on a rate that may fall.

If you need certainty, then consider fixing a portion of your home loan for a longer period. In some cases that may potentially cause your income dropping or outgoing going up, such as you’ll have a new-born soon, yourself or the other half is going to stay at home to look after the little one, or you’ll start a new business soon, we often advise to split your loan into a couple of chunks. By this way, your loan will come off fixed rate at different times and leave room for you to make adjustment if necessary.

Prosperity Finance – here to help

If you would like to get more tailored advice, please feel free to get in touch. We are happy to review your situation and let you know how we can help. Call us at 09 930 8999 for a chat with one of our mortgage advisors.

More Articles:

Disclaimer: The content in this article are provided for general situation purpose only. To the extent that any such information, opinions, views and recommendations constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised financial advice. We therefore recommend that you seek advice from your adviser before taking any action.

Archive

How likely are interest rates to go up in the near future? Here’s why we predict a NZ interest rates forecast of continued low rates…

Page updated 5 March 2021

Contents

1. NZ interest rates forecast: Executive Summary.

- Low interest rates are not a short-term aberration, but part of a long-term trend says Ben Bernanke, ex-Chair of the US Federal Reserve.

- The Reserve Bank of New Zealand influences interest rates within a small band, but has less control over interest rates than many imagine.

- If the Reserve Bank drove interest rates artificially high, the economy would slow, leading to recession. Not going to happen.

- If they drove interest rates artificially low, the economy would overheat, leading to an inflationary bubble. Not going to happen.

- Instead, they dance in the middle, tweaking rates up or down a little within a narrow band.

- Interest rates are primarily driven by inflation. Where inflation goes, interest rates follow.

- Today’s low bond yields simply reflect economists’ and investors’ expectations that inflation will remain low.

- Globalisation, offshore manufacturing and increased competition are keeping prices, and therefore inflation, down.

- With inflation lacking, markets are pricing out inflation and yields are falling as a result.

- Central bank interest rates in Switzerland are -0.75%, Japan is -0.1%, Sweden, Norway and the Eurozone (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain) are all at 0%, Denmark is near zero at 0.05%, Australia, England, Israel and Poland are at 0.1%, and the following countries are all at 0.25% – Canada, Czech Republic, New Zealand and the United States (Global-Rates).

- Our NZ interest rates forecast is for interest rates to remain at low levels for quite some time.

- Where interest rates go, mortgage rates follow. All major banks have fixed rates under 3% now, with special rates for low LVR loans (<80%) as low as 2.49%.

- With the primary driver of interest rates being inflation, which has remained stubbornly below target since the 2008-09 GFC and is predicted to remain low for quite some time…

- In our opinion, you’re more likely to see leprechauns dancing in your garden than a return to high mortgage rates in the foreseeable future.

- N.B. All predictions expire at midnight 😉

Earn 6% with Provincia industrial property fundHere’s how investors looking for a secure 6% p.a. projected pre-tax cash return can create a reliable passive income. Our conservative investment strategy has resulted in Provincia Property Fund paying investors a reliable 6% p.a. quarterly dividend ever since the fund was established in 2017 💵 As a PIE fund, it is tax effective too. You benefit from your share of Provincia’s tax deductions (e.g. depreciation), which means less of your dividend is taken by IRD than many other types of investments (e.g. term deposits) 😉 Add in capital gains and the total return compares very favourably…

Provincia Property Fund is only available to wholesale and eligible investors.

If you’d like to find out more, here’s what to do… |

2. NZ interest rates forecast: Will mortgage interest rates go up in 2021 or 2022?

Some people worry about investing in property because they think mortgage interest rates could go up in 2021 or 2022. Some even catastrophise about them shooting up to high levels.

This is understandable given our memories of high mortgage interest rates in the 80s. In fact, the 10-year bond yield hit 19.2% in May 1985!

But that was 35 years ago and we’re unlikely to see mortgage interest rates doing anything like that any time soon. (Not that we’d be distraught if they did… mortgage interest rates would only be high if inflation was high, in which case capital gains would be going through the roof!)

Instead, we are in the middle of a long-term trend of low interest rates, and mortgage interest rates dropped even further throughout 2020.

Our best prediction is that we are at the bottom of the cycle and that short-term mortgage interest rates will remain low for several years, and medium- to long-term mortgage interest rates will start firming later in 2021.

The risk is to the upside, not the downside. In plain English, interest rates are not likely to fall any further. If they do, it will be a minuscule movement.

Mortgage rates will start moving up first; term-deposit rates much later.

It is obvious now that economists called it wrong. Massively wrong. They’re even making weather forecasters look good!

A slew of economic data released in February 2021 was far more positive than economists had predicted.

Unemployment dropped from 5.3% to 4.9% in the December 2020 quarter, shocking even the most optimistic economists who instead had predicted it would rise following the end of Covid-19 wage subsidies.

New dwelling consents also hit a record high in the December 2020 quarter. New home consents were up nearly 5% compared to 2019, which is impressive considering how affected 2020 was by Covid-19 lockdowns.

On the back of better than expected economic data, business confidence bounced back strongly too.

Economists have only now (4 February 2021) abandoned their predictions the Reserve Bank of New Zealand (RBNZ) would cut the OCR again this cycle – something that has been obvious to us for some time.

Bank economists are now predicting the first OCR rate hike in May 2022.

Once again, we think they’ve got it wrong. With the housing market running hot and inflation pressure to the upside, we predict the first OCR rate hike in February 2022.

Even now in early 2021 with property prices increasing at a crazy rate, NZ inflation for the December 2020 quarter was only 2% on an annualised basis. This is bang on the Reserve Bank’s target mid-point in its 1%-3% range. StatsNZ

That means there is no inflation pressure to either increase or decrease interest rates. Furthermore, the Reserve Bank is under political pressure to not further stimulate house prices, so we think further cuts are out of the question.

The Reserve Bank could surprise us and act as early as November 2021 if inflation threatens the upper limit of the 1%-3% band it is mandated to keep inflation within.

ANZ Bank’s business confidence survey released 4 February 2021 found that businesses are concerned about the rising cost of freight and staff, due to the skills shortage.

About half of the businesses surveyed are less confident they can maintain their current levels of profitability and plan to increase prices to cover their costs.

This feeds into heightened expectations of upwards pressure on inflation, despite the drag from the loss of tourism. This in turn will put upwards pressure on the Official Cash Rate (OCR).

Don’t expect anything dramatic though…

When the OCR does start moving, which we think is likely to be as early as February 2022 (and maybe even November 2021), expect a slow creep upwards rather than dramatic changes.

We see the OCR remaining below a 1% ceiling throughout 2022.

What about mortgage interest rates? We expect medium-term and long-term rates to start increasing in 2021 in advance of the OCR, and increases in short-term rates to lag OCR increases.

If you want to lock in a long rate, now’s the time. As ex-BNZ chief economist Tony Alexander says…

“Borrowers should seriously consider forsaking the candy of cheap short-term fixed rates to lock in long rates at levels they may never see again in their lives.”

What about term deposit interest rates? ASB Bank had this to say in their Term Deposit Report of 5 February 2021…

Another year of low interest rates expected

- Low interest rates have been helping borrowers and frustrating savers over recent years.

- Term deposit interest rates have been steadily trimmed over the past year and are significantly below the average levels of the past 10-15 years.

- Interest rates are expected to stay low for several years, and we could still see some declines from today’s levels.

Note that the third bullet point relates to term deposit interest rates, not mortgage interest rates or the OCR, both of which have seen the bottom this cycle. We agree with ASB’s view.

Earn 6% with Provincia industrial property fundHere’s how investors looking for a secure 6% p.a. projected pre-tax cash return can create a reliable passive income. Our conservative investment strategy has resulted in Provincia Property Fund paying investors a reliable 6% p.a. quarterly dividend ever since the fund was established in 2017 💵 As a PIE fund, it is tax effective too. You benefit from your share of Provincia’s tax deductions (e.g. depreciation), which means less of your dividend is taken by IRD than many other types of investments (e.g. term deposits) 😉 Add in capital gains and the total return compares very favourably…

Provincia Property Fund is only available to wholesale and eligible investors.

If you’d like to find out more, here’s what to do… |

3. NZ interest rates forecast: The long-term trend of low interest rates.

The 10-year government bond yield was 7.6% on 19 January 2000, and has trended down ever since. Between 29 July 2019 and now, it’s never been over 1.5%*, mostly trading between 1% and 1.4%. (*With the exception of 2 days in late March 2020 leading up to the Covid-19 Level-4 lockdown, when it spiked to 1.63%.)

In fact…

The 10-year government bond yield sank as low as 0.98% on 16 August 2019, the lowest point in over 30 years, continuing a trend that has prevailed here and around the world as inflation pressures evaporate and evidence of a slowdown in the global economy starts to build.

On 13 May 2020, the day before we moved from Covid-19 Alert Level 3 to Level 2, the 10-year government bond yield fell even lower to 0.49% before recovering back to around the 1% mark in June 2020.

The 10-year government bond yield then began a steady 3-month decline, bottoming out at 0.44% on 28 September 2020. After treading water into November it then began a gradual recovery and now sits at around the 1% mark. You can check the latest data here.

In 2019 the Reserve Bank of Australia (RBA) was predicted to cut its rate up to 3 more times by the end of 2020. Economists at JP Morgan previously predicted the RBA would eventually take the cash rate to 0.5%. At the time of their prediction it was sitting on 1.5% and has been at 0.1% since 3 November 2020.

And where the Aussies go, we follow.

Yields in the United States and Europe have been falling too. Benchmark US 10-year bonds dipped below 2% in July 2019, and traded in a narrow band between 1.5% and 1.9% from August 2019 to February 2020, as you can see in the chart below. Since March 2020 it’s been lower still, with the benchmark US 10-year bonds trading below 1% ever since. As at 17 September 2020 the rate was 0.69%.

US 10-year Treasury Bond Yields

(Source: Financial Times)

Fed sees interest rates staying near zero through 2022

On 10 June 2020 the US Federal Reserve voted to keep benchmark short-term rates near zero and indicated that’s where they’ll stay as the economy recovers from the coronavirus pandemic.

“We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates,”Fed Chairman Jerome Powell said. “What we’re thinking about is providing support for the economy. We think this is going to take some time.”

Term Deposit Rates Nz Anz

In addition to the rates move, the Fed said it would keep buying bonds, targeting $80 billion a month in Treasurys and $40 billion in mortgage-backed securities.

The Fed sees interest rates staying near zero through 2022. The “dot plot” of committee members’ rate expectations shows little dissent about keeping rates anchored through 2022. The committee’s 17 members unanimously saw the near-zero stance holding through 2021, and only two expected that to rise in 2022. No members indicated negative rates, a question that has come up repeatedly for Fed officials during public appearances.

Those of you relying on income from interest bearing deposits, best get used to virtually nil returns. It would not surprise me in the least if we enter a period of negative interest rates where you pay the bank to hold your money. Swiss banks charge 0.75% to those who deposit funds with them. Likewise Japan has adopted negative interest rates of around -0.1%.

– Market commentator, March 2020The following chart vividly illustrates his comments…

Eurozone Bond Yields & Mortgage Interest Rates

Mark Brooks, head of income at NZ Funds, said “Globally, there is a trend where inflation is lacking so markets are pricing out inflation and yields are falling as a result.” On the outlook for interest rates, Brooks said investors would be bracing themselves for the likelihood of still lower term deposit rates.

In our opinion, you’re more likely to see leprechauns in your garden than a return to high interest rates in the foreseeable future.

Ex-BNZ chief economist Tony Alexander said more or less the same thing, albeit less vividly, in his newsletter of 8 October 2020…

Expectations have heightened that interest rates will remain at low levels for many years. Traditional fears of a bounce back in rates to previous cyclical highs have disappeared.

Earn 6% with Provincia industrial property fundHere’s how investors looking for a secure 6% p.a. projected pre-tax cash return can create a reliable passive income. Our conservative investment strategy has resulted in Provincia Property Fund paying investors a reliable 6% p.a. quarterly dividend ever since the fund was established in 2017 💵 As a PIE fund, it is tax effective too. You benefit from your share of Provincia’s tax deductions (e.g. depreciation), which means less of your dividend is taken by IRD than many other types of investments (e.g. term deposits) 😉 Add in capital gains and the total return compares very favourably…

Provincia Property Fund is only available to wholesale and eligible investors.

If you’d like to find out more, here’s what to do… |

4. NZ interest rates forecast: Central bank interest rates around the world.

- Switzerland: -0.75%

- Japan: -0.1%

- Eurozone: 0%

- Sweden: 0%

- Norway: 0%

- Denmark: 0.05%

- Australia: 0.1%

- England: 0.1%

- Israel: 0.1%

- Poland: 0.1%

- Canada: 0.25%

- Czech Republic: 0.25%

- New Zealand: 0.25%

- United States: 0.25%

(Source: global-rates.com – List of current central bank interest rates)

5. NZ interest rates forecast: Why are interest rates so low?

Ben Bernanke, who served two terms as Chair of the Federal Reserve, wrote…

Low interest rates are not a short-term aberration, but part of a long-term trend. As the figure below shows, 10-year government bond yields in the United States were relatively low in the 1960s, rose to a peak above 15% in 1981, and have been declining ever since. That pattern is partly explained by the rise and fall of inflation, also shown in the figure. All else equal, investors demand higher yields when inflation is high to compensate them for the declining purchasing power of the dollars with which they expect to be repaid.

– Ben Bernanke (Source: The Brookings Institution)If inflation rises, interest rates will follow. But as we all know, we live in a low-inflation environment. Today’s low bond yields simply reflect economists’ and investors’ expectations that inflation will remain low.

Earn 6% with Provincia industrial property fundHere’s how investors looking for a secure 6% p.a. projected pre-tax cash return can create a reliable passive income. Our conservative investment strategy has resulted in Provincia Property Fund paying investors a reliable 6% p.a. quarterly dividend ever since the fund was established in 2017 💵 As a PIE fund, it is tax effective too. You benefit from your share of Provincia’s tax deductions (e.g. depreciation), which means less of your dividend is taken by IRD than many other types of investments (e.g. term deposits) 😉 Add in capital gains and the total return compares very favourably…

Provincia Property Fund is only available to wholesale and eligible investors.

If you’d like to find out more, here’s what to do… |

6. NZ interest rates forecast: Can the Reserve Bank drive interests rates back up to high levels again?

In a word, No. Here’s Ben Bernanke again…

But what matters most for the economy is the real (inflation-adjusted) interest rate… The Fed’s ability to affect real rates of return, especially longer-term real rates, is transitory and limited. Except in the short run, real interest rates are determined by a wide range of economic factors, including prospects for economic growth – not by the Fed.

– Ben BernankeIf the Fed can’t affect US rates, what chance is there that our Reserve Bank could drive NZ interest rates up?

If our Reserve Bank kept interests rates artificially high, the economy would slow and fall into recession. This is because businesses don’t make capital investments when the cost of borrowing set by the Reserve Bank is greater than the potential return on those investments.

Nobody likes a recession, least of all our politicians, so… this scenario will never happen.

Similarly, if the Reserve Bank pushed market rates artificially low, the economy would eventually overheat, leading to inflation – also an unsustainable and undesirable situation.

The bottom line is that the state of the economy, not the Reserve Bank, ultimately determines interest rates. The Reserve Bank influences market rates in the short term, but not in an unconstrained way.

In short, we believe interest rates will continue their march towards zero.

7. NZ interest rates forecast: Fixed-term mortgage interest rates today.

This table gives a snapshot of the current lowest advertised fixed-term mortgage interest rates on offer from New Zealand’s main retail banks today…

Current NZ Bank Fixed Mortgage Interest Rates Today

(For mortgages below 80% LVR. As at 5 March 2021.)

To underscore how much NZ bank mortgage interest rates have dropped, in May 2017 the average 2-year fixed mortgage interest rate was 4.8%. By May 2018 it had dropped to 4.5% and in May 2019 it had dropped even further to 3.95%. By May 2020 it was down to 3.0% and on 27 November 2020 it was sitting at 2.58%. It hasn’t changed much since then and currently sits at 2.53%. (Source)

8. NZ interest rates forecast: Term deposit interest rates today.

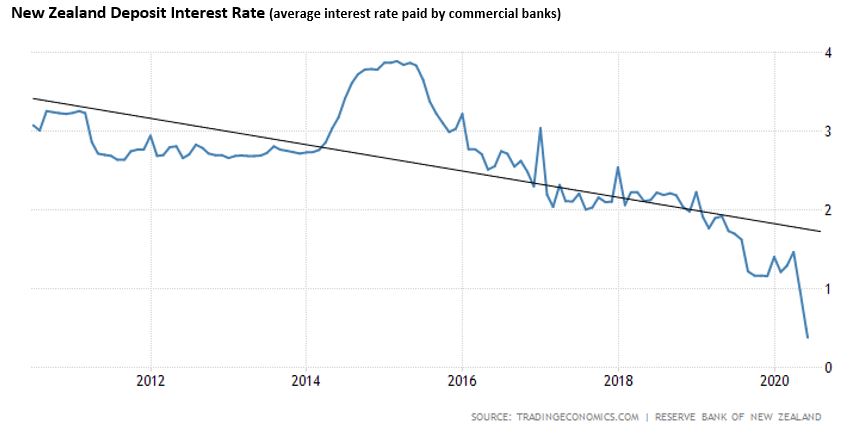

As if one needed any more proof, take a look at the following graph of 1-year NZ bank term deposit savings/investment rates in New Zealand from January 2008 to April 2020, a time span of 12 years.

You can see a huge drop of nearly 5% in NZ bank 1-year term deposit rates following the GFC, followed by a short-lived 1% bounce back, and then a continuation of the downward trend right through to today.

With the exception of a few small blips along the way, that’s 12 years of declining term deposit interest rates. The interest rate train has had no brakes and been running downhill for a very long time. It’s now running along the valley floor but has so much momentum we don’t expect it to stop any time soon.

1-year NZ Bank Term Deposit Interest Rates in NZ

Term deposit rates today

Interest Rates In New Zealand

The following list details the best current term deposit rates for $10,000+ in New Zealand for the major NZ trading banks today…

Current NZ Bank Term Deposit Interest Rates Today

(Term deposits of $10,000+. As at 5 March 2021.)

Note: Many of these rates are unchanged from our 17 December 2020 update. Notable exceptions are Kiwibank’s current 1-year special rate of 1.0% and ASB’s surprise increases this week from not much to not much more. ASB’s rate changes took effect on Tuesday 2 March 2021.

The average 12-month term deposit rate at the beginning of 2019 was 3.36%(source). Current rates are therefore down to one-quarter of 2019’s rate.

We are in a global COVID-19 recession (not so much in New Zealand). People are currently being driven by fear and money is flowing into bank accounts. This is not the GFC and banks do not have a funding problem, so the need for banks to aggressively compete for deposits is not strong.

With uncertainty continuing to reign, expect term deposit rates to stay low for a long time.

On 30 July 2020 ex-BNZ chief economist Tony Alexander said, “Every week brings some new, small, declines in term deposit rates as banks seek to build their interest rate margins to try and offset the losses they know they will eventually book from business failure and debt restructuring associated with this crisis.”

And then on 31 August 2020 ASB Bank said this in their Economic Weekly update…

Our forecasts for term deposit rates and mortgage rates have been slashed.

We think that an RBNZ scheme to lower the OCR below zero and lend directly to banks, if introduced, would heap downward pressure onto term deposit rates.

They’re already at rock-bottom levels, but we see further downside.

In short, we think term deposit rates could fall below 1% with mortgage rates for some terms below 2%.

How prescient he was. Term deposit interest rates have since fallen to well below 1%. Mortgage interest rates, however, are still in the mid 2% range and at this stage are unlikely to fall below 2%.

BTW, the chances of the OCR falling to zero, let alone below zero, have all but evaporated. We calculate that we are currently at the bottom of the interest rate cycle and therefore don’t see the OCR being lowered any further this cycle.

9. NZ interest rates forecast: After-tax retirement income today.

Let’s assume you are a retiree and your only source of income is the pension and interest on a $1 million term deposit at 0.8% p.a. That puts you on a 17.5% income tax rate.

Your after-tax income from that whopping $1 million term deposit is a pitiful $6,600 p.a. That’s only $126.92 per week. Who can live on that?

In the current low-interest rate environment, is it any wonder people are chasing higher-yield investments?

Earn 6% with Provincia industrial property fundHere’s how investors looking for a secure 6% p.a. projected pre-tax cash return can create a reliable passive income. Our conservative investment strategy has resulted in Provincia Property Fund paying investors a reliable 6% p.a. quarterly dividend ever since the fund was established in 2017 💵 As a PIE fund, it is tax effective too. You benefit from your share of Provincia’s tax deductions (e.g. depreciation), which means less of your dividend is taken by IRD than many other types of investments (e.g. term deposits) 😉 Add in capital gains and the total return compares very favourably…

Provincia Property Fund is only available to wholesale and eligible investors.

If you’d like to find out more, here’s what to do… |